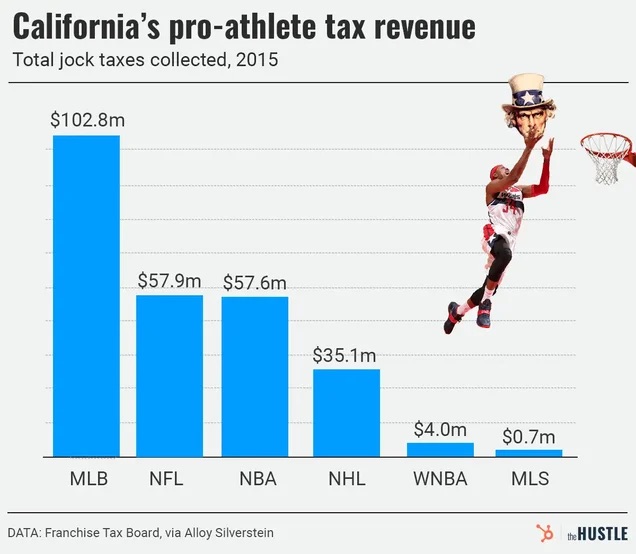

Professional athletes make millions — but where they play can dramatically impact how much they actually take home. One of the biggest financial factors for visiting teams is the California Jock Tax.

Here’s everything you need to know about how it works, who pays it, and why it matters in contract negotiations across the NFL, NBA, and MLB.

What Is the California Jock Tax?

The “Jock Tax” is a nickname for income taxes that states impose on professional athletes (and other high-earning performers) for income earned while working in that state.

In California, athletes must pay state income tax on the portion of their salary tied to games, practices, meetings, and team-related work performed within state lines.

Because California has the highest top state income tax rate in the country (13.3%), the financial impact can be significant.

Which Teams Trigger the California Jock Tax?

Visiting players owe California income tax when they play against teams such as:

- Los Angeles Lakers

- Golden State Warriors

- Los Angeles Rams

- San Francisco 49ers

- Los Angeles Dodgers

- San Diego Padres

Even one road trip to California can create a sizable tax obligation.

How the Jock Tax Is Calculated

California uses what’s called a “duty days” formula.

What Are Duty Days?

Duty days include:

- Game days

- Practice days

- Team meetings

- Travel days related to games

An athlete’s salary is divided by total duty days in the season. The percentage of those duty days spent in California determines how much income is taxable by the state.

Example Calculation

Let’s say an NFL player earns $10 million annually:

- 160 total duty days

- 10 duty days in California

- 6.25% of salary taxable in California

- $625,000 subject to California tax

- At 13.3% = about $83,125 owed to California

And that’s just for games played in California.

Why It Became Known as the “Jock Tax”

The term gained popularity in the early 1990s when California aggressively pursued tax revenue from visiting players, including members of the Chicago Bulls during the championship era of Michael Jordan.

Since then, most states with income taxes have adopted similar policies targeting visiting professional athletes and entertainers.

Does It Only Apply to Athletes?

No. The California Jock Tax can also apply to:

- Coaches

- Team executives

- Referees

- Entertainers on tour

Anyone earning income while temporarily working in California may owe state income tax.

How It Impacts Free Agency and Contracts

The California Jock Tax is often discussed in comparisons between high-tax states and no-income-tax states like Texas and Florida.

For example, players on teams such as the Dallas Cowboys or Miami Dolphins do not pay state income tax on their home-game earnings.

While visiting players still owe taxes in other states when traveling, athletes based in no-tax states generally retain more of their home-game salary.

This can affect:

- Contract negotiations

- Salary cap strategy

- Net take-home comparisons

- Free agency decisions

Do California-Based Players Pay More?

Yes. Players who live and play full-time on California teams owe state income tax on all income earned in California, not just road games. That can significantly impact long-term earnings compared to players based in no-income-tax states.

Final Thoughts

The California Jock Tax ensures that professional athletes pay state income tax on income earned within California’s borders. With rates reaching 13.3%, it can cost high-earning players tens or even hundreds of thousands of dollars per season.

For fans, it’s an interesting financial layer behind player movement and contract negotiations. For athletes and agents, it’s a key factor in evaluating offers across different states.